The annual Black Friday shopping festival in the US kicked off last week, officially kicking off the Christmas and New Year shopping season in the West. While the highest inflation rate in 40 years has put pressure on the retail market, Black Friday as a whole has set a new record. Among them, toy consumption remains strong, becoming an important driving force for overall sales growth.

The total number of shoppers hit a new high, and offline consumption remained strong.

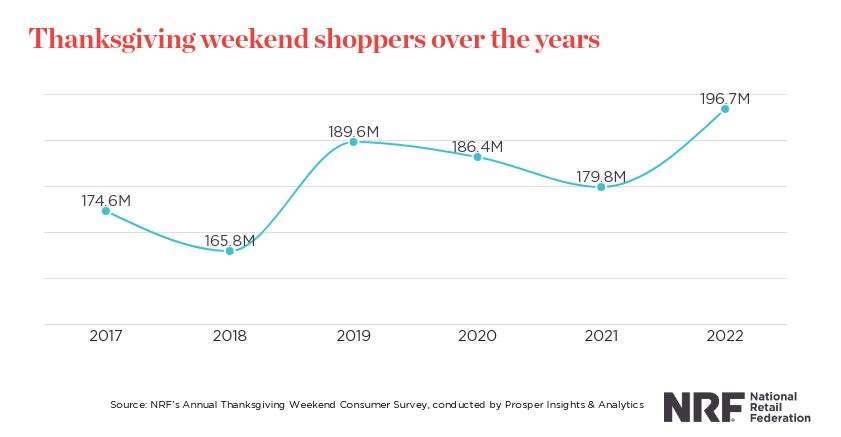

Survey data released by the National Retail Federation (NRF) and Prosper Insightful &Analytic (Prosper) show that during Black Friday in 2022, A total of 196.7 million Americans shopped in stores and online, an increase of nearly 17 million over 2021 and the highest number since the NRF began tracking the data in 2017. More than 122.7 million people visited brick-and-mortar stores this year, up 17 percent from 2021.

Black Friday remains the most popular day for in-store shopping. About 72.9 million consumers opted for the traditional face-to-face shopping experience, up from 66.5 million in 2021. The Saturday after Thanksgiving was the same, with 63.4 million in-store shoppers, up from 51 million last year. MasterCard’s Spending-pulse reported a 12% increase in in-store sales on Black Friday, not adjusted for inflation.

According to the NRF and Prosper consumer Research, consumers surveyed spend an average of $325.44 on holiday-related purchases over the weekend, up from $301.27 in 2021. Most of that ($229.21) was earmarked for gifts. “The five-day Thanksgiving shopping period continues to play an important role throughout the holiday shopping season.” Phil Rist, executive vice president of strategy at Prosper. In terms of types of purchases, 31 percent of respondents said they purchased toys, second only to clothing and accessories (50 percent), which ranked first.

Online sales hit a record high, with daily toy sales up 285%

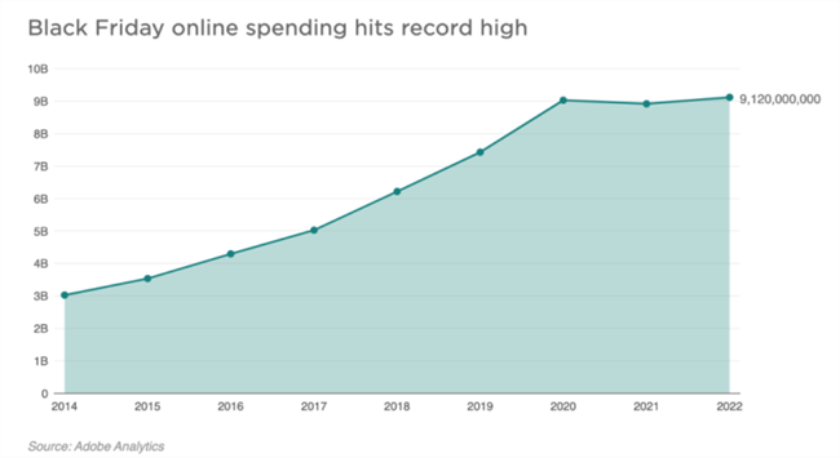

The performance of toys on e-commerce platforms is more prominent. There were 130.2 million online shoppers on Black Friday this year, up 2% from 2021, according to the NRF. According to Adobe Analytics, which tracks more than 85% of the top 100 US online retailers, US consumers spent $9.12 billion on online shopping during Black Friday, up 2.3% from the same period last year. That’s up from $8.92 billion for the same period in 2021 and $9.03 billion for the “Black Friday” period in 2020, another record, driven by deep discounts on mobile phones, toys and fitness equipment.

Toys remained a popular category for shoppers on Black Friday this year, with average daily sales up 285% from the same period last year, according to Adobe. Some of the hottest games and toy merchandise this year include Fortnite, Roblox, Bluey, Funko Pop, National Geographic Geoscience kits and more. Amazon also said home, fashion, toys, beauty and Amazon devices were the best-selling categories this year.

Amazon, Walmart, Lazada and others are offering more deals this year than in previous years, and extending them for a week or more. According to Adobe, more than half of consumers switch retailers for lower prices and use “online price comparison tools.” Therefore, this year, some e-commerce rookies through a variety of promotional means “rise to prominence”.

For example, SHEIN and Temu, the cross-border e-commerce subsidiary of Pinduoduo, not only launched ultra-low discounts during the promotion period of “Black Friday”, but also brought to the American market the commonly used collectivy-word welfare collection and exclusive discount code of KOL. TikTok has also launched events like a live studio chart contest, a Black Friday shopping short video challenge, and sending discount codes online. Although these upstarts have yet to make toys their main category, there are signs that they are bringing new changes to traditional American e-commerce, which is worth watching.

Epilogue

The outstanding performance of toy consumption in the United States “Black Friday” shows that the market demand is still strong under the pressure of inflation. According to the NRF’s analysis, year-on-year retail sales growth for the season that runs through the end of December will range from 6 percent to 8 percent, with the total expected to reach $942.6 billion to $960.4 billion. More than two weeks before Christmas, expect the toy consumer market to continue the good momentum.